Revenue leakage has become one of the biggest silent profit killers for Shopify merchants in 2025. Stores enter BFCM with strong traffic and high ROAS, yet the final numbers rarely match the effort. Money slips away through gaps merchants don’t immediately see: failed payments, refund spikes, chargeback losses, tracking inconsistencies, and checkout breakdowns under pressure.

Most brands don’t lose profit because their marketing underperforms.

They lose it because leakage happens at every step of the revenue flow before purchase, during checkout, and long after fulfillment.

Understanding where revenue leakage comes from, why it accelerates during peak season, and how to stop it is now a core competitive advantage.

This playbook breaks down the hidden mechanics of leakage and shows how Shopify merchants protect margins by building systems that retain more of what they earn.

Retained Revenue: The Real Metric That Decides Profit in 2025

For years, Shopify merchants measured success by how fast revenue could grow. More orders, more campaigns, more reach. But in 2025, growth without control is no longer enough. The real advantage now lies in retained revenue – the revenue that stays after leakage is removed.

During last year’s BFCM, brands lost between 8 and 12% of total sales to hidden revenue leakage. Tracking gaps, slow checkout scripts, refund delays, chargeback spikes, and churn all compounded into margin loss that most merchants didn’t see until weeks later. Each issue alone seems minor, but together they drain the profit margin built across the entire year.

This is why leading Shopify merchants have shifted from optimizing for “more revenue” to engineering systems that hold revenue in place. They audit the entire revenue chain: how data is tracked, how checkout performs under load, how payments recover, and how post-purchase workflows retain buyers.

When merchants eliminate leakage, revenue becomes stable, measurable, and predictable. Because growth only matters when it stays in the business, not when it slips through operational cracks.

The Anatomy of Revenue Leakage

Every Shopify store loses money somewhere, but most don’t know where or how much. Revenue leakage rarely comes from one dramatic failure, it comes from dozens of small breakdowns that multiply when traffic spikes. As systems strain under BFCM volume, every weak link becomes a source of loss.

During the Purchase Journey

Revenue leaks start before the customer even completes a purchase. Pre-purchase tracking issues distort performance signals, checkout friction slows transactions, and fraud filters sometimes block legitimate buyers. These leaks quietly erode revenue long before the order is created.

- Tracking & Attribution Leaks: Missing events, misfiring pixels, or out-of-sync channels cause merchants to scale based on false data.

- Checkout Execution Leaks: Script conflicts, discount logic errors, and slow-loading payment steps increase drop-off.

- Fraud & Authorization Leaks: False declines and high-friction authentication refund earned revenue and add fees.

After the Purchase

Once the order is placed, new forms of leakage emerge. Operational delays, slow refunds, and weak retention mechanics reduce margin and lifetime value often invisibly.

- Operational Leaks: Inventory sync delays, overselling, shipping errors, and fulfilment slowdowns trigger refunds and additional support load.

- Refund & Returns Leakage: Inefficient return handling or long refund cycles damage customer trust and reduce repeat purchase likelihood.

- Retention & Subscription Leakage: Missed replenishment timing or failed recurring payments cause unintentional churn.

The Revenue Leakage Framework

To stop revenue leakage, merchants need more than isolated fixes. You need a layered system that prevents loss before it happens, absorbs pressure during peak traffic, and recovers revenue after the sale. This framework covers the five layers that protect Shopify stores from silent profit drain.

Data Integrity Layer

A stable data layer ensures that all revenue-related events are structured, validated, and synced across Shopify, marketing platforms, and analytics tools.

This prevents cascading leakage caused by:

- Misaligned event schemas

- Unverified server-side revenue events

- Inconsistent attribution rules

- UTM fragmentation across campaigns

The purpose of this layer is data governance, not tracking repair.

Checkout Resilience Layer

This layer focuses on engineering a checkout that remains fast, predictable, and conflict-free under peak load.

It includes:

- Script orchestration and execution order control

- Payment routing logic optimization

- Load-testing discount systems

- Mobile-first rendering safeguards

Its job is to prevent execution failures, not describe the friction itself.

Fraud & Dispute Control Layer

A modern risk layer automates fraud detection while preserving approval accuracy.

Key capabilities include:

- Real-time behavioral scoring

Automated dispute submissions - Liability shift systems

- False-decline suppression models

This layer focuses on reducing future leakage, not recounting past losses.

Operational Continuity Layer

This layer ensures that operational systems (ERP/WMS/3PL/Returns) sync flawlessly with Shopify.

It provides:

- Real-time inventory state consistency

- Automated return routing logic

- Fulfillment SLAs built for peak volume

- System monitoring for stock and order anomalies

Purpose: stop operational failures before they create refunds.

Margin Retention Layer

This layer stabilizes revenue by strengthening predictable customer value.

It includes:

- Replenishment & win-back automation

- Smart retry of failed renewals

- Predictive churn modeling

- Personalized post-purchase experiences

This layer is about recovering high-risk revenue, not re-listing leakage types.

Case Studies: Revenue Leakage in Action

Real revenue leakage doesn’t show up in dashboards, it shows up in refunds, chargebacks, failed checkouts, and operational friction. These four Shopify brands illustrate how different parts of the revenue chain can leak, and how targeted fixes recover profit immediately. Each case highlights a specific leakage pattern, the intervention, and the measurable lift.

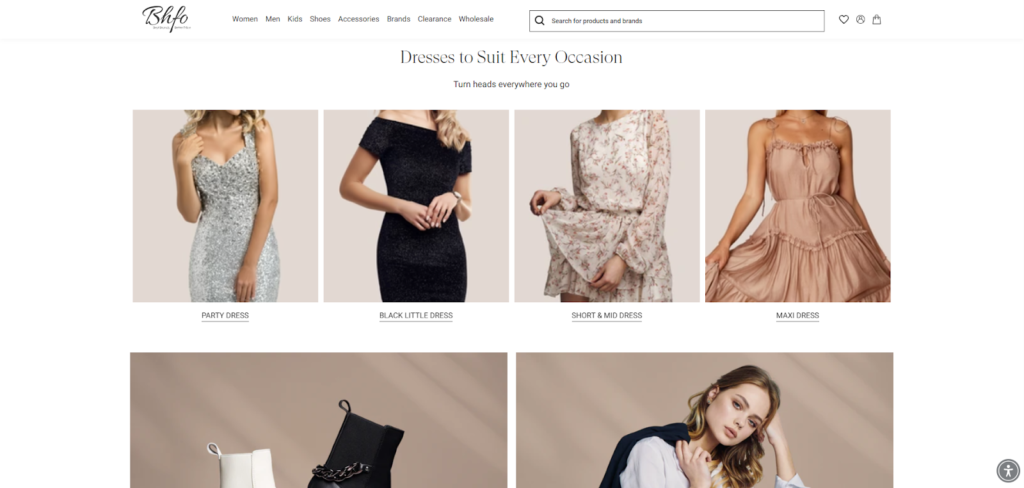

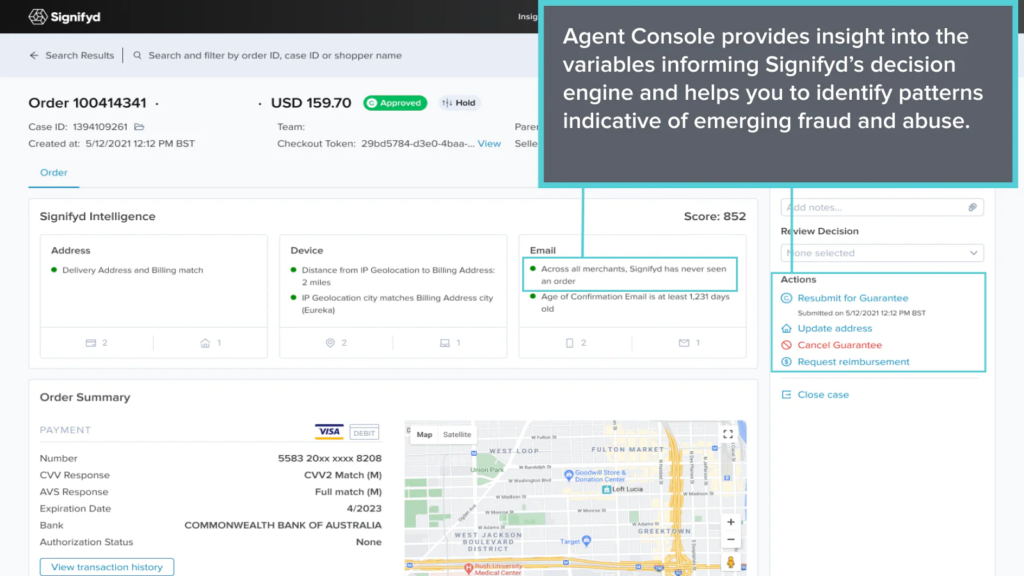

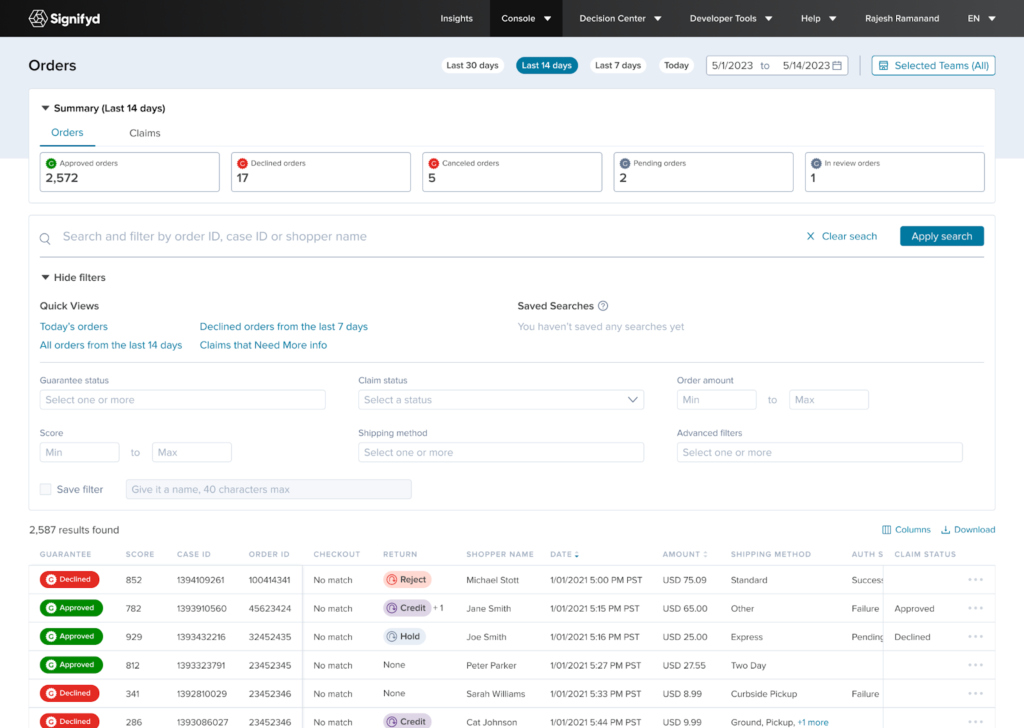

BHFO – Eliminating chargeback-driven revenue leakage

Problem

BHFO, a large U.S. apparel reseller, faced a surge in chargebacks during BFCM 2024. Manual fraud reviews overwhelmed the operations team, slowing approvals, delaying shipments, and increasing dispute fees. The process protected against risk but created mounting revenue leakage, especially as false declines blocked legitimate customers.

Fix

To stop the leak, BHFO implemented Signifyd’s guaranteed fraud and chargeback automation layer. The system replaced manual reviews with real-time risk scoring, automated dispute responses, and a full liability shift away from the merchant. This stabilized approvals and removed the operational bottleneck that had been slowing fulfillment.

Result

With automated protection in place, BHFO achieved a 69% reduction in chargeback rate and increased approval accuracy to 99.66%, while eliminating the majority of manual dispute work. The brand recovered margin that had been quietly slipping through chargebacks and false declines during peak demand.

Lesson

Chargebacks aren’t just a fraud issue, they are a recurring source of revenue leakage that compounds under peak traffic. Addressing them early protects both profit and operational capacity.

Impact Insight

For BHFO, the win wasn’t just risk reduction; it was the ability to retain more of the revenue they already earned without slowing growth efforts.

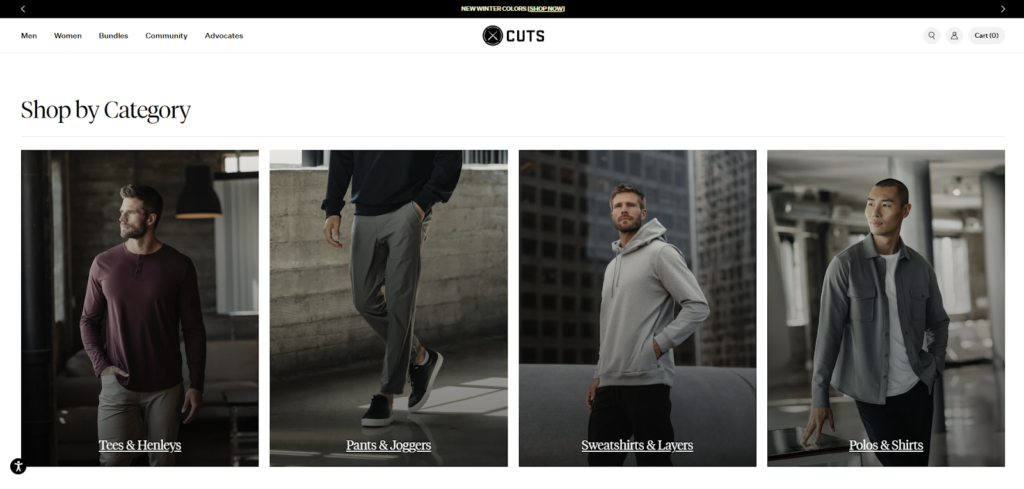

Cuts Clothing – Fixing payment approval friction that blocked high-intent buyers

Problem

Cuts Clothing, a fast-growing premium apparel brand, saw a spike in false declines and payment friction during peak periods, particularly across international orders. The brand was losing high-intent customers at checkout, creating significant revenue leakage that never appeared directly in analytics. Manual fraud screening slowed processing times, frustrated buyers, and left the team without visibility into why legitimate transactions were being rejected.

Fix

Cuts deployed Signifyd’s automated fraud and payment authorization layer to stabilize approvals and eliminate manual review. Real-time risk modeling replaced guesswork and protected legitimate customers while filtering out truly risky orders. The system removed checkout friction, improved authorization logic, and ensured consistent decisions across domestic and international traffic.

Result

With automated authorization in place, Cuts Clothing saw higher approval precision, fewer false declines, and a smoother checkout experience. According to Signifyd’s published case data, Cuts accelerated order processing and captured revenue previously lost to manual review delays and incorrect declines, turning a hard-to-measure leak into a controllable metric.

Lesson

For high-growth brands like Cuts, the biggest leak isn’t fraud itself, it’s the legitimate customers who get blocked by overly rigid or manual fraud systems. Protecting the customer experience is one of the most effective ways to stop revenue leakage at checkout.

Impact Insight

Once Cuts stabilized approvals, its paid acquisition became more efficient, because the brand was no longer losing the very buyers it paid to acquire. Fixing the leak improved both margin and marketing ROI without increasing spend.

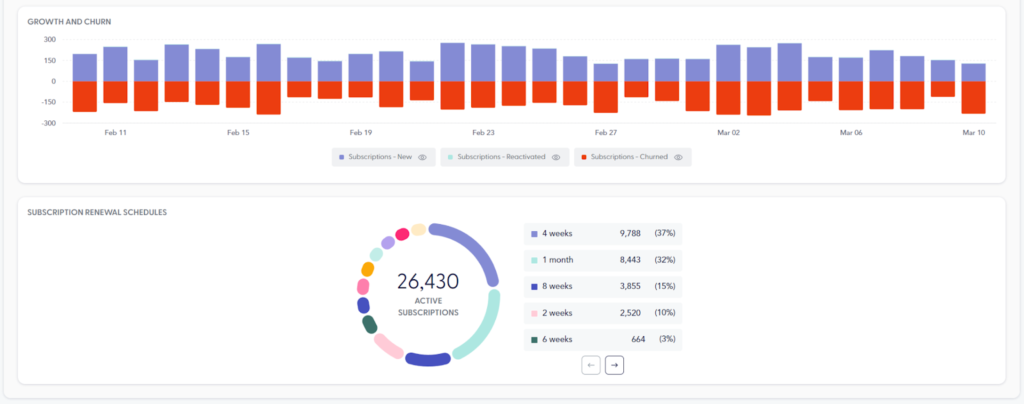

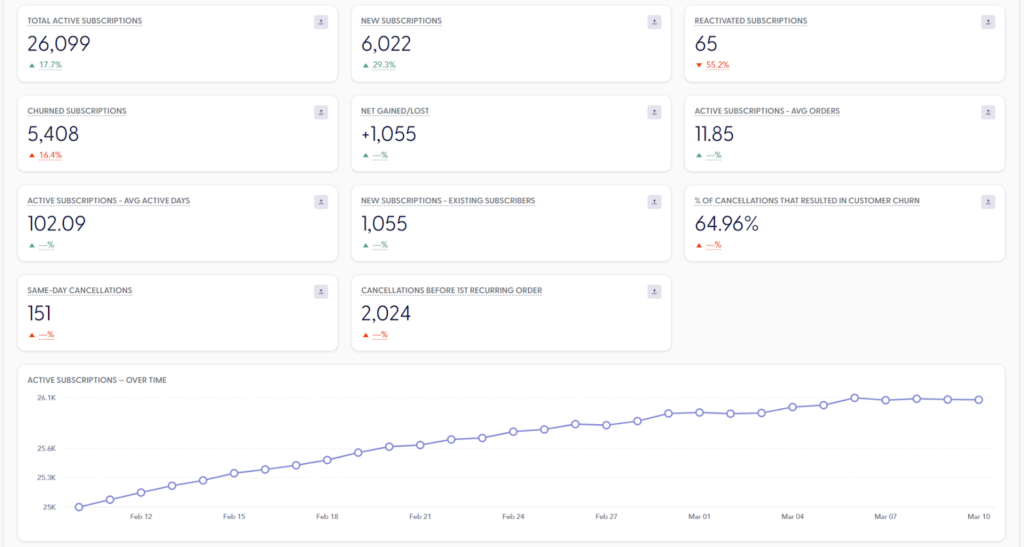

Wild Earth – Recovering lost subscription revenue through smart payment retry

Problem

Wild Earth, a subscription-based pet nutrition brand, struggled with a growing volume of failed recurring payments – one of the most common and costly forms of revenue leakage for subscription merchants. Expired cards, insufficient funds, and inactive subscribers led to churn that wasn’t intentional, but purely operational. These silent failures eroded MRR, created unpredictable cash flow, and forced the team into manual follow-ups that rarely scaled.

Fix

Wild Earth implemented Recharge Retain’s smart retry and churn recovery workflows. The system automatically detected failed renewals, retried payments at optimized intervals, and triggered targeted re-engagement emails before churn finalized. All workflows synced directly with Shopify’s subscriber data, ensuring a seamless and automated recovery experience.

Result

Recharge’s published data shows Wild Earth recovered 88% of failed subscription payments, transforming a recurring leak into a predictable revenue channel. The brand reclaimed revenue that had previously been lost quietly through billing failures.process was seamless for the buyer and required zero manual intervention from Wild Earth’s team.

Lesson

In subscription commerce, churn is often not intentional, most of it comes from preventable payment failures. Automating recovery is one of the fastest ways to stop revenue leakage and stabilize recurring revenue.

Impact Insight

By stabilizing renewal revenue, Wild Earth increased long-term customer value and reduced reacquisition costs. Fixing this one leak strengthened the entire subscription model’s financial reliability.

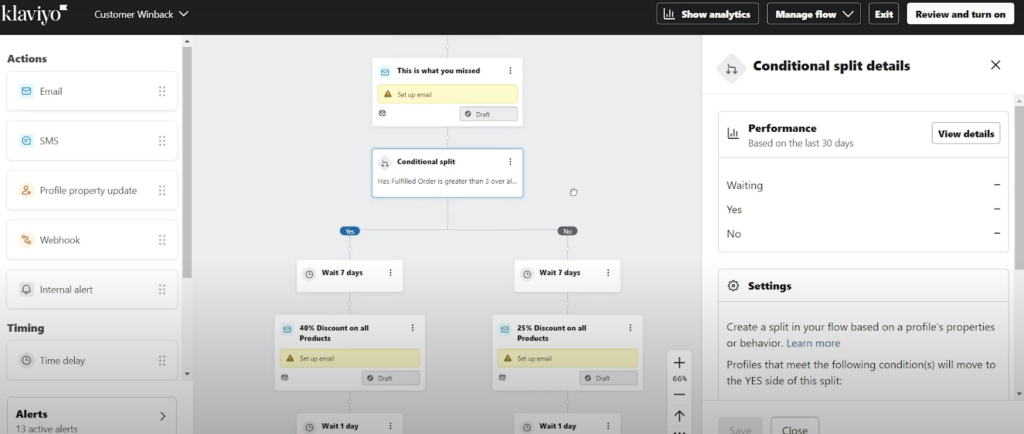

Balance Me – Closing post-purchase leakage with lifecycle retention allows

Problem

Balance Me, a U.K. clean skincare brand, noticed declining repeat-purchase rates and inconsistent replenishment behavior across its online customers. Even though acquisition remained strong, the brand experienced a steady stream of post-purchase revenue leakage caused by long gaps between product usage cycles, missed replenishment moments, and customers who simply forgot to reorder. Without structured retention flows, most potential LTV gains slipped away before the team could identify the cause.

Fix

To reduce leakage, Balance Me implemented automated Klaviyo replenishment and win-back flows tailored to product lifecycle timing. These workflows triggered reminders based on expected usage windows, delivered personalized offers for at-risk customers, and used dynamic content to re-engage buyers before churn. Because the flows were built on Shopify’s real purchase and behavior data, the messaging aligned naturally with individual customer needs.

Result

With lifecycle-driven automation in place, Balance Me saw higher replenishment consistency and a lift in returning-customer revenue. Klaviyo’s published case data highlights that replenishment flows contributed a measurable share of revenue, improving retention without additional marketing spend. The brand effectively recaptured revenue that had previously leaked through unstructured post-purchase engagement.

Lesson

Retention leakage often happens quietly, not through refunds or fraud, but through missed timing and lack of follow-up. Aligning communication with real product usage cycles is one of the most reliable ways to keep revenue leakage from accumulating over time.

Impact Insight

By closing the gap between purchase and repurchase, Balance Me increased customers’ lifetime value and improved revenue predictability. Fixing this leak strengthened overall performance without raising acquisition costs – a compounding advantage for any DTC skincare brand.

The KPIs That Reveal Revenue Leakage Before It Grows

Revenue leakage rarely shows up as a single obvious failure. It accumulates quietly through false declines, delayed checkouts, refund inefficiencies, failed payments, and declining retention, long before a merchant realizes profit has slipped away. That’s why leading Shopify brands monitor a specific set of KPIs built not to measure growth, but to expose where revenue is leaking and how fast the leak is spreading.

These KPIs form an early-warning system. When they move even slightly, they signal friction that impacts margin, not marketing. Combined, they give merchants a clear view of how much revenue they are keeping versus how much is slipping through operational cracks.

| KPI | Target Benchmark | Why It Matters |

| Approval Rate | ≥ 99% | A drop in approval rate means legitimate customers are being incorrectly declined – one of the most expensive forms of revenue leakage because it affects high-intent buyers you’ve already paid to acquire. |

| Chargeback Ratio | < 0.5% | Chargebacks drain revenue twice: you lose the order and pay fees to resolve it. Rising ratios indicate a leak in fraud control and post-purchase protection. |

| Checkout Success Rate | ≥ 97% | Every failed checkout is lost revenue. A low success rate reveals technical friction, overloaded scripts, or broken discount logic – all major leakage points during peak. |

| Payment Recovery Rate | ≥ 80% | Failed subscription renewals are silent profit killers. A low recovery rate indicates recurring leakage from involuntary churn, not customer intent. |

| Refund Latency | < 48 hours | Slow or inconsistent refunds create leakage through support backlog and reduced loyalty. Long refund cycles directly hurt LTV and push customers away. |

| Repeat Purchase Rate | Increasing QoQ | When repeat purchase rate stalls, post-purchase leakage is rising. Strong retention protects margins and maximizes the value of every customer acquired. |

Why These Metrics Matter More Than Growth KPIs?

Traffic can be scaled and ads can be optimized, but leakage compounds quietly until it overwhelms profit. These KPIs shift the merchant mindset from “How much revenue did we generate?” to “How much revenue did we keep?”

Once leakage becomes visible, merchants can fix the exact bottleneck: checkout friction, fraud disputes, billing failures, or retention gaps and recover revenue without increasing spend.

Maybe you want to read: The Ultimate 2025 Guide to Tracking Your eCommerce Website

Implementation Timeline: Before → During → After BFCM

Revenue leakage becomes most visible during BFCM because every system: checkout, payments, fraud, operations, retention is under its highest pressure of the year. The brands that stay profitable don’t just react during the rush; they follow a structured timeline that strengthens weak links before volume hits and recovers losses after it ends. Below is the three-phase plan merchants use to contain leakage across the entire peak cycle.

30 Days Before BFCM – Audit and Stabilize the Revenue Chain

This is where the biggest gains happen. Merchants review their end-to-end revenue flow: approval rates, checkout performance, tracking accuracy, subscription recovery, and refund latency. Any leakage detected here multiplies under peak traffic, so the focus is on stabilizing core systems early.

Key actions:

- Audit checkout scripts and payment routing

- Benchmark approval rate and chargeback ratio

- Load-test discount logic

- Fix tracking discrepancies (UTM, pixel, multi-channel attribution)

- Review refund workflows and return SLAs

Stopping leakage now prevents margin collapse later.

BFCM Week – Monitor Stability and Protect High-Intent Revenue

During peak week, the objective shifts from fixing to protecting. Systems should already be hardened; now you monitor them under pressure. This is where real-time dashboards matter: approval drops, checkout delays, or spike in refunds are the earliest signs of active leakage.

Key actions:

- Monitor approval rate hourly

- Watch for checkout slowdowns or script collisions

- Automate dispute handling and fraud review

- Prioritize fulfillment accuracy to avoid refund-triggered leakage

- Protect subscription renewals from payment failures

Small issues during this week turn into massive leakage within hours.

After BFCM – Recover Revenue and Strengthen Retention

Once the surge ends, merchants shift into recovery mode. Failed payments, chargebacks, delayed refunds, and first-time buyers without a structured retention plan all contribute to post-purchase revenue leakage. The goal is to reclaim lost revenue and convert one-time customers into repeat buyers.

Key actions:

- Run smart retries for failed subscription payments

- Automate refunds where possible to reduce latency

- Process disputes fast with guaranteed fraud tools

- Launch replenishment and win-back flows

- Analyze leakage hotspots from the week and reinforce systems

What happens after BFCM decides whether the revenue surge becomes sustainable profit or slips away.

Expert Insight – Why Controlling Leakage Is the Real Driver of Growth

Most merchants talk about scaling revenue; few talk about scaling what they keep. In reality, revenue leakage is the single biggest barrier between high traffic and high profit. When systems break under pressure, whether through false declines, checkout friction, slow refunds, or failed renewals growth becomes an illusion. Dashboards show revenue up, but margin quietly slips away.

What separates the strongest Shopify brands isn’t how aggressively they acquire customers, but how effectively they prevent loss across the revenue chain. When leakage is controlled, every campaign becomes more efficient. Every returning customer becomes more valuable. Every checkout becomes more predictable. Profit stops depending on volume and starts depending on reliability.

The truth is simple: protecting revenue is no longer a defensive strategy. It is the foundation of scalable growth. The brands that win BFCM aren’t the ones who sell the most, they are the ones who keep the most.

Quick Answers: Merchant Questions About Shopify Protection

What is the biggest problem with Shopify in 2025?

For many merchants, the biggest problem is unseen revenue leakage, not the platform itself. Issues like false declines, slow checkout scripts, refund delays, and failed subscription renewals quietly erode profit. These problems only appear when merchants examine operational data, not dashboard revenue.

How much does Shopify take from a $100 sale?

Shopify typically takes a combination of platform fees + payment processing fees, depending on your plan and payment method. While the fee itself isn’t leakage, misconfigured payment routing or high failed-payment rates can cause merchants to lose far more than the platform cost. Fees are predictable; leakage is not.

Why do Shopify stores fail?

Many stores fail not because they lack traffic, but because they leak more revenue than they retain. Poor checkout performance, high refund volume, inventory sync errors, weak retention, and rising acquisition costs can all wipe out margin even when revenue grows.

Is Shopify still profitable in 2025?

Yes, but only for merchants who control leakage. Rising CAC and operational costs mean that profitability now depends on retaining revenue, not just generating it. Brands with strong fraud control, stable checkout, and post-purchase automation remain highly profitable.

How do I avoid unnecessary transaction costs on Shopify?

You can reduce avoidable costs by optimizing payment routing, using Shop Pay where eligible, and preventing failed transactions that trigger reprocessing fees. Most “cost leakage” comes from failed payments, chargebacks, or operational delays, not from the platform fee itself.

Why is no one buying from my Shopify store?

Often the issue isn’t demand, it’s friction. Slow pages, broken discount logic, trust gaps, or declines at checkout can create leakage before revenue is captured. Fixing leakage usually improves conversion faster than increasing traffic.

Conclusion

Revenue leakage is the silent force that erodes profit long before merchants see the impact.

Checkout friction, false declines, chargebacks, failed payments, and weak retention all chip away at margins, even when revenue looks strong on the surface. The brands that scale profitably aren’t the ones driving the most traffic; they’re the ones who keep more of what they earn.

Controlling leakage turns growth into something predictable. It strengthens margins, improves the value of every paid customer, and stabilizes operations during peak pressure. The sooner merchants reinforce these foundations, the more revenue they retain when BFCM volume hits.

Wgentech partners with Shopify merchants to identify and eliminate leakage across the entire revenue chain. Audit your store now before hidden losses shape your peak-season results.